INDUSTRY 4.0 AND 5G IN THE COVID PANDEMIC

A SURVEY BY ARC ADVISORY GROUP AND WIND RIVER

The Impact of COVID-19 on Industry 4.0

The Industry 4.0 initiative had been underway for nearly ten years in 2020 when the COVID-19 pandemic suddenly disrupted the global economy. Industry 4.0 represents the “fourth industrial revolution” in manufacturing. The first industrial revolution introduced mechanization through steam power. The second developed mass production and assembly lines that used electric power. The third came through adoption of computers and automation. The fourth revolution will enhance and empower manufacturing through smart and autonomous production systems that use data and machine learning.

What has been the impact of COVID-19’s sudden and severe disruption on manufacturer’s programs to enable their manufacturing operations to leverage this fourth industrial revolution? The year 2020 was expected to feature the introduction of new technologies into manufacturing; most notably 5G wireless telecommunications, Wi-Fi 6 networks, and edge computing. But very suddenly in 2020 manufacturers were simply struggling to keep factories and plants open and maintain whatever production they could in an unprecedented pandemic environment.

How would new technology initiatives fare in such an environment? Will the pandemic derail some of these programs, just delay them, or (perhaps) speed them up? What would be the impact on investments in new 5G infrastructure or other new technologies?

A Post-COVID Survey

To research the climate for these Industry 4.0 programs and new information and communications technology (ICT) infrastructure to support them, ARC collaborated with Wind River to design a survey targeting manufacturing and high-tech executives in North America and the EU. The objective of the survey was to identify the types of initiatives that were underway, the underlying business objectives, the potential use cases and technologies that were being considered, and the perceived impact of 5G and other emerging ICT technologies on these programs.

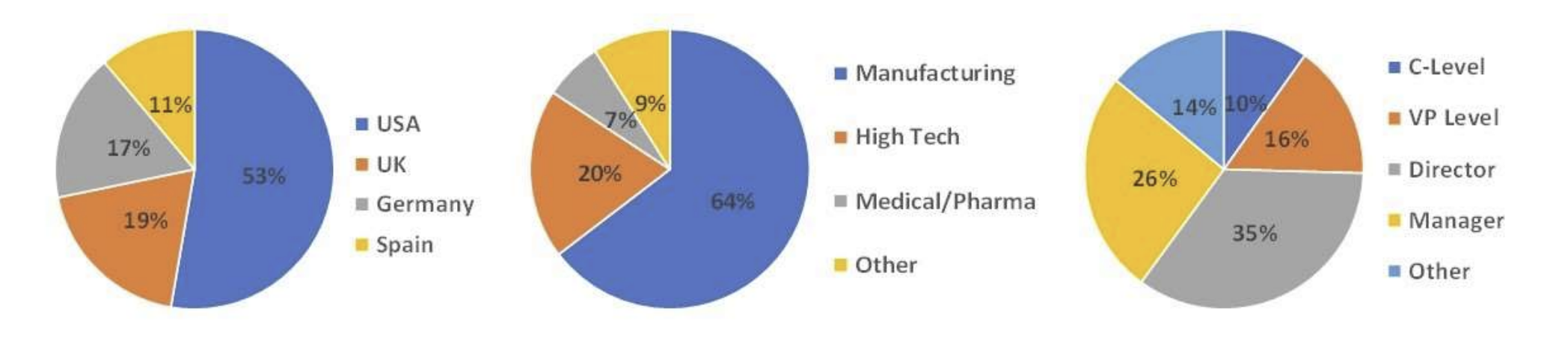

The survey had over 450 valid responses. Respondents were recruited from four countries. Roughly half were from the United States and the other half from three EU countries (UK, Germany, and Spain). The persons who were targeted as survey respondents were mid to high level executives. A majority of respondent job titles are at the manager or director level with a quarter of the respondents having job titles of either Vice President or a C-Level job title. At these types of levels, respondents are well informed about ongoing initiatives within their company and savvy to the underlying strategic reasons for selecting programs and areas of focus.

The survey was conducted during the 3rd quarter of calendar year 2020, so this survey data is “post-COVID” in that during that quarter firms around the globe were wrestling with the disruptions caused by the COVID-19 pandemic and with how to serve their customers in a business and social environment characterized by a pandemic. This period of time featured far higher than normal uncertainty about business operations and profitability. The onset of disturbances caused by COVID-19 was very sudden, and these have persisted and likely will persist for quite some time. But survey responders were certainly aware of the pandemic, of its impact on their business, and of their efforts to operate during a pandemic.

Selected Survey Results

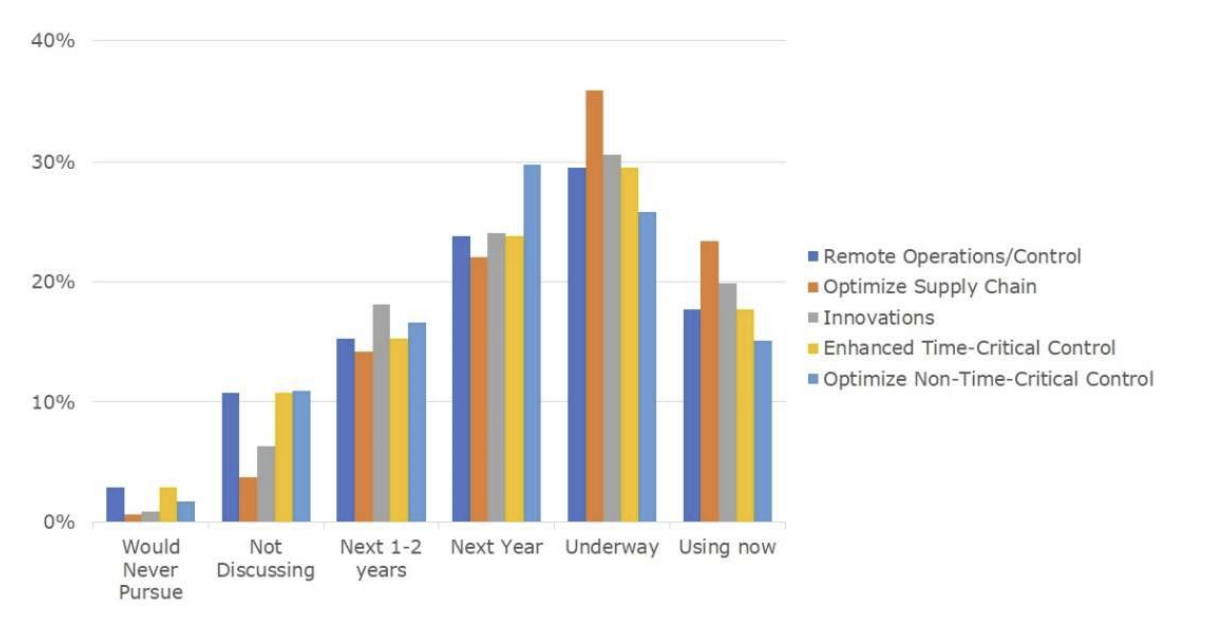

The survey asked: “Please review each of the following ‘next generation’ process improvement initiatives that could have a significant impact your company’s business strategies, objectives and outcomes. For each initiative, please indicate which is true with respect to your company’s development or integration plans.”

Here is a chart of the results:

What the chart shows is that many companies are working now on new or improved solutions in all five of these areas rather than just one or two, and that a great deal of activity is still going on right now and is planned for the next year or so. All these areas are important to the firms, but supply chain improvement has the highest attention. This is not surprising, given that the COVID-19 pandemic has disrupted so many supply chains in 2020 and exposed many vulnerabilities that still need to be evaluated and addressed.

Also noteworthy is that this was a single choice not a multiple-choice question. So, while a substantial fraction reported they are now using apps for all 5 areas, this does not mean they are finished or will not be making additional effort and investment going forward.

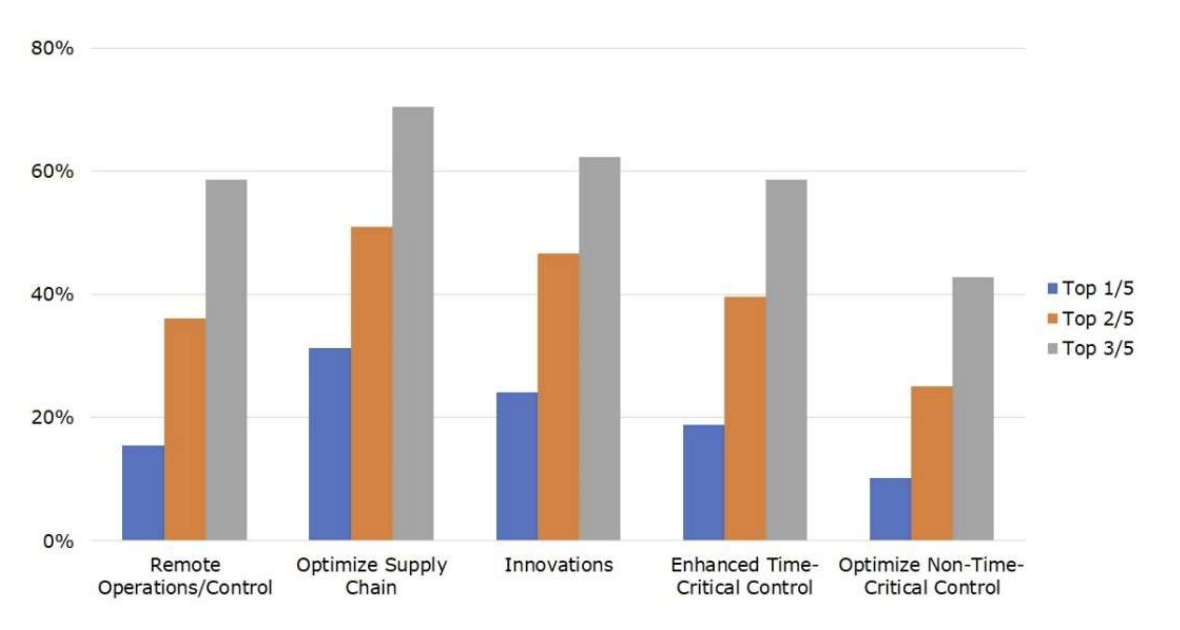

As a follow-up question we asked: “Please rank each of the [5 improvement areas]in the order of importance your company’s overall strategic plan.”

Here are the results

This result also supports supply chain improvements as most critical. Product/service innovation ranks second. It’s interesting to note that both improvements cannot be realized overnight but must be developed over time. New applications can greatly facilitate and guide this, but these decisions are longer term decisions that provide benefits over time.

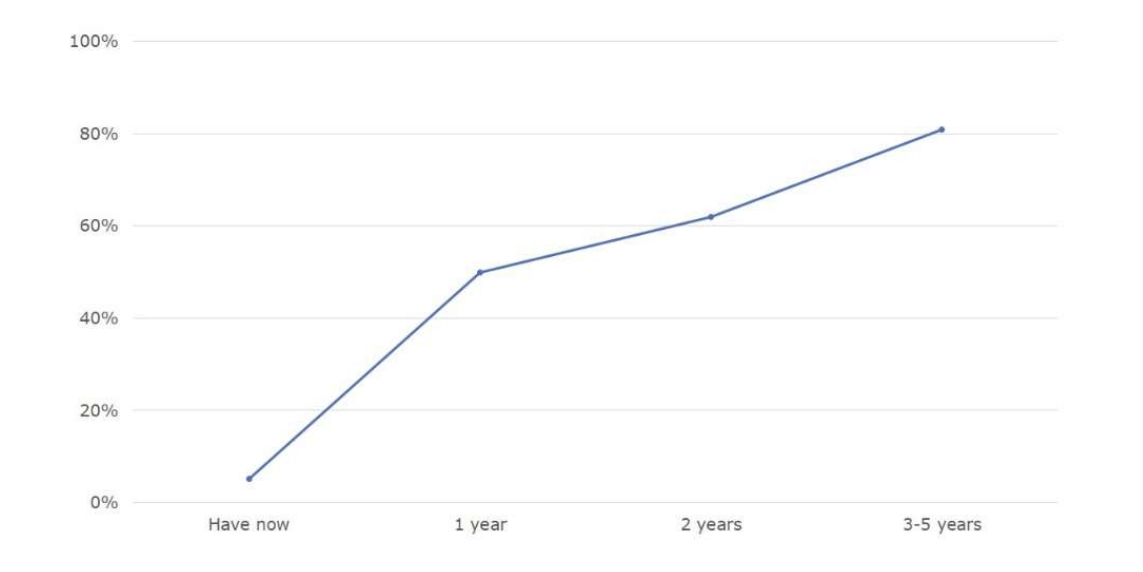

5G Impact and 5G Consideration

The transition to 5G cellular networks offers a new dimension in cellular data services, especially to manufacturers. The 5G standards enable communications service providers (CSPs) to deliver entirely new sets of services to manufacturers, and also enables manufacturers to deploy their own private 5G infrastructure, if they wish. So, the survey asked specifically about plans for 5G. First we asked “How likely is your company to adopt 5G-enabled technologies in the next 12 months? How about in the next 13-24 months? How about in the next 3-5 years?”

Here is the fraction of respondents who found 5G adoption “very likely” in these time frames.

While very few had experience with 5G, the majority expected to be using 5G within 2 years, and an overwhelming majority expected to use it within 3-5 years. Surprisingly, the North American respondents were even more positive about future 5G deployments than Europeans.

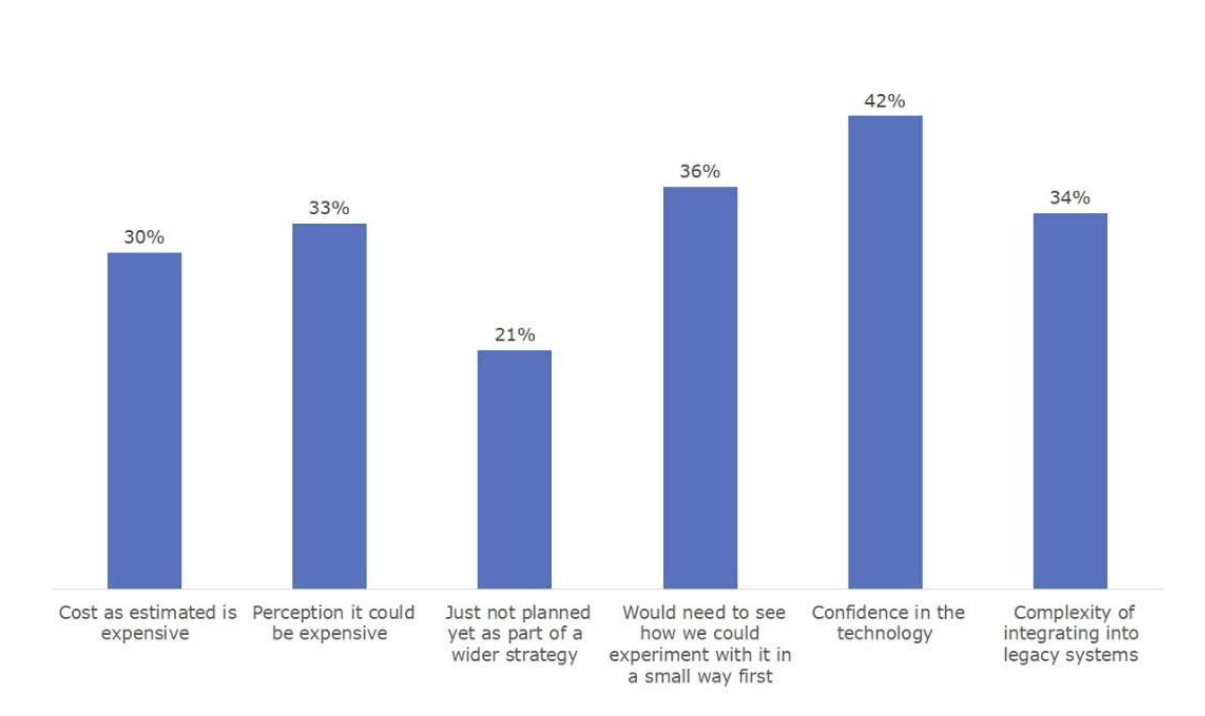

Next, we asked about perceived barriers to 5G deployment in their industrial setting, allowing the respondents multiple choices. Here are these results.

Confidence, cost, and complexity were all perceived barriers to industrial 5G deployment, with confidence being the most frequently cited. Let’s discuss each of these perceived barriers in more detail from the plant owner-operator’s perspective.

Confidence: Plants today either use, or own and operate several distinct types of network infrastructures. These serve a huge variety of applications. While all these applications are important, some are highly critical in that even a brief service interruption can cost millions of dollars or (even more seriously) jeopardize personnel safety or environmental protection. That is why “confidence” is required for infrastructures that support critical or safety-related applications.

Manufacturer’s incumbent LTE cellular and Wi-Fi infrastructures are largely relegated to applications where “best efforts” delivery and occasional unplanned service interruptions do not impact production and can be tolerated. For the most critical apps, where production and safety are at stake, owned and dedicated networks are still the norm. This includes networks such as industrial ethernets for production equipment control and land mobile radio (LMR) for critical voice communication.

Why would a plant support a specialized and expensive LMR infrastructure when a carrier’s LTE could provide equivalent services? The answer is because the manufacturer is confident that these critical services will still be available in times of natural or man-made disaster (hurricane, terrorist incidents, etc.). They rely on these applications for safety and critical operations. They do not have enough confidence that a carrier’s LTE services will be available at quality at the times when they are most needed.

ARC believes that network infrastructure suppliers need to be aware of this wide range of criticality and create service level agreements that provide some measure of risk-sharing with industrial customers. While it is challenging to deliver “six nines” of network reliability, in reality industrial customers may accept less reliability if they have control over when network outages occur. It is the unplanned outages that cause them concern.

Cost: This consideration is secondary to safety and critical applications, but it always plays a part in investment decisions. Cost of coverage is an important element. Very large sites, especially outdoor sites (for example a surface mine or a bulk chemical plant) are expensive and/or very difficult to cover, especially with short range PANs and WLANs. In addition to the technical difficulty, such sites will have equipment requirements for operation in hazardous environments, which compounds the already high installed cost.

Besides installed cost, any infrastructure requires some ongoing support. Private LTE, and private or semi-private 5G installations may require additional support investments for organizations that have little or no experience with them.

Complexity: This consideration is really a component of the support area. Operational problems with network infrastructure are usually escalated from OT groups to corporate IT and finally to suppliers such as OEMs and CSPs. The more complex the infrastructure, the more likely that resolving operational issues will require supplier support and the additional time this takes.

ARC Take-Aways

The most apparent conclusion is that while COVID has made the year 2020 an “Annus Horribilis” for manufacturers, the disruptions have done little to derail their Industry 4.0 programs. Rather, the disruptions to operations and supply chains, plus the far greater need for remote operations and support have illustrated the timeliness and importance of these initiatives.

With respect to 5G adoption, manufacturers seem aware that 5G represents a sea change not just in raw network performance but also in the capabilities and qualities of services that can be delivered through cellular infrastructure. But to turn enthusiasm into adoption, CSPs will need to understand and appreciate the requirements new and more critical applications within the factory or plant impose on their networks and on their business relationships with manufacturing customers.

More information and results of this survey are available through Wind River. Contact inquiries@windriver.com for more information.

Recommendations

Based on ARC research and analysis, we recommend the following actions for owner-operators:

- Manufacturers should evaluate the life-cycle costs of 5G infrastructure with a view to its new properties and capabilities vis-à-vis their incumbent networking and connectivity solutions.

- As they expand the range of 5G manufacturing applications beyond those served by LTE, manufacturers should expect CSPs to understand the risks of critical manufacturing applications and to design service level agreements to reflect and/or share in bearing these risks.

- CSPs need to learn which applications their industrial customers plan for 5G and appreciate the levels of criticality of these apps to their industrial operations. They should plan their SLAs and support with a view toward risk reduction and risk-sharing.